An optimistic start to “Uptober” was swiftly shattered for traders when the stock and cryptocurrency markets plunged at the opening bell.

On October 1, the whole cryptocurrency market fell as investor enthusiasm for “Uptober” seemed to be dampened by growing geopolitical tensions in the Middle East, an increase in long liquidations, and a sell-off in US equities.

The entire value of the cryptocurrency market fell by more than 1.3% to almost $2.22 trillion in the last day, while stocks declined.

As the situation in the Middle East worsens, cryptocurrency prices decline.

Following fears of a potential escalation in the Middle East between Iran, Lebanon, and Israel, there was volatility in stocks and digital assets on October 1.

According to Disclose.tv, the US has intelligence that Iran is getting ready to strike Israel with a ballistic missile.

According to CNBC, Israeli Prime Minister Benjamin Netanyahu declared that the current course of action “will not be enough.” If oil prices keep rising, inflation will probably rise and the US Federal Reserve would be less able to lower interest rates.

The Dow Jones index fell 302 points, or 0.7%, and the S&P 500 was down 1.1% an hour after Wall Street began on October 1. The decline in the Nasdaq Composite index was 1.4%.

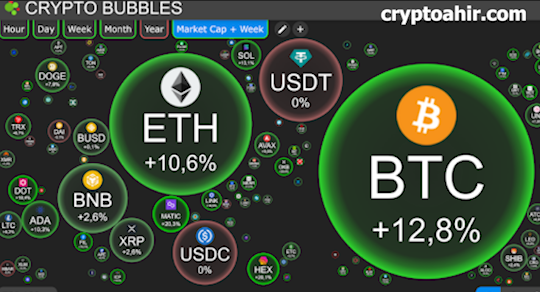

Cryptocurrency prices also showed a great deal of volatility. At the time of publishing, Bitcoin BTC was trading at $61,503, having dropped 2.6% in the previous day to trade at that level. However, it had since recovered to $62,557. Ether ETH is down $0.381.39. After falling 12.6% to $2,534, it is currently trading 0.5% higher at $2,569.

Related: Three indications that the Q3 closure of Bitcoin was optimistic

Crypto traders are caught off guard by almost $340 million in liquidations.

According to CoinGlass data, long traders—those who are banking on the cryptocurrency market’s upward trajectory—have seen liquidations totaling $291.3 million in the past day. In contrast, nearly $55.6 million in liquidations were incurred by short sellers during that time.

According to CoinGlass statistics, the total value of liquidated bitcoin positions hit $53 million in the last four hours, with leveraged positions totaling over $71.8 million for the day. As of the time of publication, there had been $346.8 million in liquidations in the larger cryptocurrency market during the past day.

Traders who are counting on rising prices are compelled to sell their bets when long positions are liquidated, frequently at a loss. The current valuation of the cryptocurrency market has decreased due to the increased selling pressure.

In the meantime, the decline in open interest implies a reduction in the number of active futures contracts, which suggests that traders are retreating from the market and closing their holdings.

However, the majority of popular coins, like as Bitcoin and Ether, have positive funding rates, which suggests that traders who are still active in the market are typically more optimistic since they are prepared to pay a premium to hold onto long positions.